A bank reconciliation involves comparing your sales and expense records with your bank’s records. This critical financial process helps identify and correct any discrepancies or errors between your financial data and the transactions reflected in your bank statement. Bank reconciliations are vital for maintaining accurate bookkeeping, which can help reduce tax liabilities, alert you to […]

As a business owner, you’re always looking for ways to save time. Every minute spent on admin tasks or fixing mistakes is a minute that could be used to grow your business. When time is money, finding ways to cut down on repetitive tasks is essential—technology can help. Improve Billing Billing can take up a […]

Creating a personal financial plan is a vital step toward achieving financial stability and reaching your long-term goals. A well-structured financial plan acts as a roadmap, guiding you through various financial decisions and helping you navigate life’s uncertainties. Here’s Accountants Plus’s step-by-step guide to crafting your personal financial plan: Set Clear Financial Goals […]

Creating an effective invoice is crucial for ensuring timely payments and maintaining professionalism in your business. Here’s Accountants Plus’s concise guide to help you craft clear and professional invoices. What is an invoice? An invoice is a document used to request payment for goods or services provided. It also serves as a record for […]

When it comes to managing finances, the terms “bookkeeper” and “accountant” are often used interchangeably. However, their roles and responsibilities within a business are distinctly different, though complementary. A bookkeeper is primarily responsible for recording and maintaining the daily financial transactions of a company. This includes tasks such as documenting sales, purchases, receipts, and […]

In the dynamic landscape of business, prudent spending is crucial for long-term success. Whether you’re a startup or an established enterprise, managing your spending budget efficiently can spell the difference between thriving and struggling. Here are some practical tips to help you navigate and optimise your business spending: Firstly, start with a comprehensive assessment […]

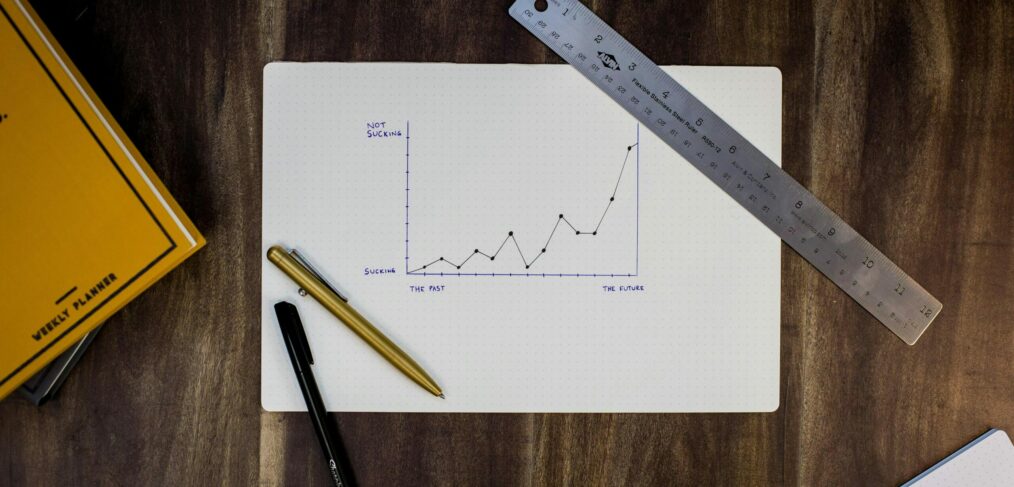

In the dynamic landscape of entrepreneurship, the quest for business growth often leads to the assumption that external funding is the only catalyst for expansion. However, a judicious approach to internal strategies can foster sustainable growth without relying on external capital. Here’s a roadmap for entrepreneurs keen on nurturing their ventures organically. Operational Efficiency: […]

In the fast-paced world of business, financial stability is crucial for sustained growth. Whether you’re a small startup or an established enterprise, effective budgeting is the cornerstone of sound financial management. As Accountants Plus is dedicated to guiding businesses on their financial journey, we understand the importance of implementing smart budgeting tips and strategies. Here […]

As the dawn of a new year unfolds, small businesses find themselves at a crossroads, armed with the opportunity to redefine their path to success. For many entrepreneurs, setting clear and strategic goals is the compass that guides them through the challenges and triumphs of the business landscape. In this blog post, we’ll delve into […]

In the competitive landscape of New Zealand’s business scene, small enterprises often find themselves facing formidable challenges when trying to compete with big chains. Here are six ways your small business can compete with the big chains: 1. Build Personal Connections One of the most significant advantages that small businesses possess is […]